Seven years into China's Belt and Road.

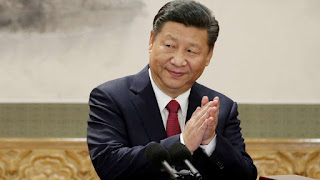

President Xi Jinping of China proposed the Belt and Road Initiative (BRI) in a couple of addresses in 2013. In Kazakhstan, he illustrated a dream of reestablishing overland shipping lanes from China to Central Asia and Europe — the antiquated "Silk Road." In Indonesia, he presented the idea of a "sea Silk street," which is basically the effectively very much voyaged ocean passageway South from China to the Middle East and Europe. In seven years of execution, the activity has gotten very dubious, particularly in the West. The discussion is powered by an absence of straightforwardness that makes it hard to get solid data on the financing associated with the activity, just as the particular ventures and their terms. There are a developing number of scholastic endeavors, in any case, to gather and break down information on BRI, with a predictable arrangement of discoveries.

In spite of the name, the program is worldwide, not bound to the particular halls. It is principally a program to support framework. Around 66% of the financing goes to power and transport. Absolute financing has been on the request for $50-100 billion every year. The greater part of the advances are in dollars on business standing that are more liberal than creating nations can get from private financial specialists, yet substantially more exorbitant than assets from Western givers or the concessional windows of the multilateral improvement banks. Various significant customers of China are notable outcast states, for example, Iran or Venezuela. Be that as it may, by and large Chinese financing across nations is uncorrelated with proportions of vote based system: as it were, other significant borrowers are majority rule governments, for example, South Africa, Kenya, Tanzania, Indonesia, or Brazil.

A World Bank concentrate in 2019 inspected the vehicle ventures along the overland and oceanic courses. It inferred that there were possibly enormous advantages to the beneficiary nations and to the world if transport expenses could be diminished through improved foundation. However, the examination likewise found that much of the time strategy obstructions were more noteworthy than framework obstacles – that is, import duties, venture limitations, customs delays, administration, formality, and debasement frequently increment exchange costs significantly. The unmistakable point from this examination is that improving the venture atmosphere is a fundamental supplement to putting resources into foundation. One commonsense approach to do this is through profound economic alliance, for example, the Trans-Pacific Partnership which incorporates some significant creating economies, for example, Colombia, Malaysia, Peru, and Vietnam. The U.S. could have tied this gathering of Asia-Pacific economies a lot nearer to our framework however decided to drop out. Then, China has arrived at an exchange progression arrangement among ASEAN, Japan, South Korea, Australia, and New Zealand. It's anything but a profound arrangement, yet it takes out levies on parts and segments and establishes a framework for Asian worth chains that prohibit the U.S.

BRI raises various issues for the U.S. American authorities have condemned the program as "obligation trap strategy." This dread appears to be overstated. The majority of the nations getting from China likewise acquire from Western benefactors, the multilateral banks, and private investors. They have differentiated wellsprings of fund, and there is no motivation to feel that they are especially obliged to China. The exemptions would be the untouchable states, and in building up a technique for managing Venezuela or Iran it is critical to consider China's speculations and interests there.

While it is elusive proof of obligation trap discretion, there are genuine worries about obligation maintainability that are pertinent for all banks. Unfamiliar obligation is unique in relation to homegrown obligation in that it eventually must be adjusted by means of fares, and there are clear cutoff points to how much obligation helpless nations can take on. Besides, the pandemic and downturn commute home how rapidly the view of maintainability can change. Preceding COVID-19, most creating nations glanced great as far as obligation maintainability, as indicated by IMF examination. In any case, the downturn is devastatingly affecting GDP and fares. Of China's principle customers in Africa, a greater part are presently owing debtors trouble or at high danger of obligation trouble. China has joined the other G20 nations in offering helpless nations a ban on obligation overhauling during 2020. For China's 15 major customers in Africa, a lot of 2020 obligation overhauling is around 33% – a figure that shows both the significance of Chinese money yet in addition that other authority banks and the private division are all things considered significantly more significant. China's investment in the obligation ban is positive, however it is just a little initial step since premium will be collecting and obligation loads rising. A few nations are probably going to require obligation rebuilding or compose downs, ordinarily sorted out through the Paris Club, of which China isn't a part. The U.S. has an enthusiasm for bringing China into the Paris Club and helping out China on obligation alleviation to guarantee that there is certifiably not another round of obligation emergencies deadening the creating scene.

The U.S. has dispatched another improvement fund organization to contend with China. Giving creating nations additionally financing sources is a savvy system, yet this activity without anyone else will likely not change the image definitely. Creating nations have different subsidizing sources as of now. They want to utilize Chinese financing for huge undertakings in transport and force for explicit reasons. Private subsidizing is too costly and present moment (normally max five years). Western benefactors and their multilateral banks give gives or loan on exceptionally liberal terms. However, these conventional benefactors want to back social administrations, organization, vote based system advancement – they have escaped hard foundation totally. In its initial days, 70% of World Bank financing went to monetary foundation; presently, it is around 30%. Identified with that, doing enormous framework with the Western contributors is regulatory and tedious; fundamentally, helpless nations need to follow first-world guidelines. Along these lines, nations soundly distribute China to do ship and force, the Western givers to do social divisions, and private bondholders to give general, momentary spending fund.

In rundown, a more compelling reaction to BRI with respect to the U.S. would: grasp new, profound economic accords that would improve the venture atmosphere in creating nations and tie them all the more near the U.S.; lead a change of the multilateral banks and its new money organization that would smooth out the formality around foundation extends and give an appealing other option; dial down the counter China way of talking; and urge China to be more straightforward and to give more liberal terms and take an interest owing debtors alleviation varying.

Comments

Post a Comment